The Builders Guide During The Crypto Bear Market

Challenging times call for composure and innovation, not panic and desperation.

Bear markets have existed since the beginning of time, and much like any adversity in life, you have a choice on how to tackle it — use it to your advantage or succumb to the negative wave. Before we explain how to build in the crypto bear market, let’s get some definitions out of the way.

What is a bear market?

A crypto bear market is when prices contract and remain low for an extended period. During this challenging time, investors are extra vigilant and preservative as they foresee market volatility without clear signals.

Examples of crypto bear markets

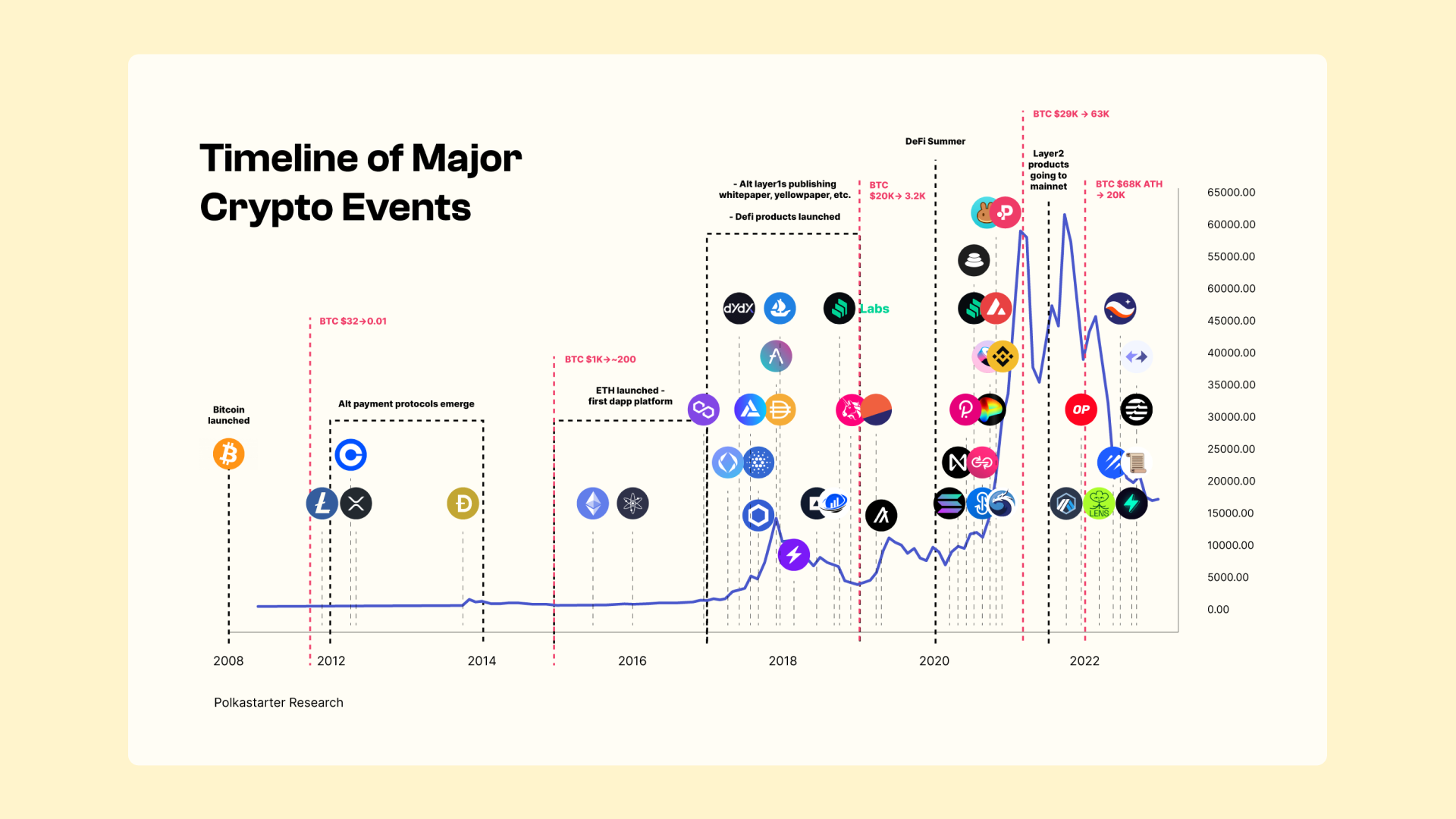

The bear market has appeared more than once in the industry’s young life. To keep things in perspective, this is somewhat expected as this is a breed of technology that comes to uproot and challenge our ideas of finance and transactions. Let’s examine some of the most notable moments in crypto bear market history.

Bear Market #1: Bitcoin tumbled from $32 to $0.01 in 2011

In late April 2011, the price of Bitcoin broke through the key psychological threshold of $1, launching the first-ever rally that saw it reach $32 on June 8, 2011. The happiness, however, was short-lived as Bitcoin's price fell precipitously over the next few days, eventually bottoming out at just $0.01.

The now-defunct Japanese cryptocurrency exchange Mt. Gox was largely blamed for the sudden sell-off as most Bitcoin was traded at the time. A security lapse on the exchange's platform caused the theft of 850,000 BTC, which raised serious questions about the safety of Bitcoin held on exchanges.

Bear Market #2: Bitcoin crashed from $1,000 to below $200 in 2015

Shortly after breaking $1,000 for the first time in history, Bitcoin entered a severe bear market, with its price falling below $700. The price fell due to Chinese authorities cracking down on Bitcoin in late 2013 and banning local financial institutions from processing BTC transactions.

Bear market #3: Bitcoin falls below $3,200 after hitting $20,000 in December 2017

At the end of 2017, Bitcoin rallied to as high as $20,000. The joy of reaching that threshold was fleeting, however, as Bitcoin subsequently declined and lost more than 60% of its value in months. As the Bitcoin market continued to shrink, with BTC bottoming out at roughly $3,200 in December 2018, the year 2018 quickly came to be known as a "crypto winter."

Bear market #4: BTC plummets from $63,000 to $29,000 in 2021

Bitcoin's price gradually declined to as low as $29,000 in three months after reaching new all-time highs ($63,000) in April. The growing media narrative following the 2021 mini-bear market was that Bitcoin mining was a problem in regard to environmental, social, and corporate governance (ESG).

Bear market #5: Bitcoin slumps from $68,000 to below $20,000 in 2022

After failing to surpass $70,000, Bitcoin started to decline in late 2021. Since November of 2021, cryptocurrency has been in a bear market and has likely experienced one of its biggest crashes ever in 2022. The cryptocurrency fell below $20,000 in June for the first time since 2020, igniting a market-wide panic.

Entering the spring of 2022, Bitcoin and the crypto market went through one of the most vicious crashes ever when the price collapsed below $20,000 in June after peaking at $68,000 in 2021.

And then there was light.

How did we reach the crypto bear market?

This long and complicated subject probably garners a dedicated content piece, but we’ll try to give you some context. On 30 April 2022, Terra (LUNA) tokens were valued at US $78 per token. In just one month, after an alleged “financial attack”, it has lost 99.99% of its value at worst.

The collapse of the Terra ecosystem led to a spiral of unmitigated disaster for the entire ecosystem. Investors, enthusiasts, and believers lost trust in the technology and the crypto construct. Then came the FTX collapse to add insult to injury and compound the negative sentiment around the industry. Moreover, let’s not forget the lingering pandemic effects, supply chain disruptions and the trade war between the U.S. and China, rising inflation, as well as the Russian invasion of Ukraine.

There’s a lot more that went into the creation of the bear market, but events that made headlines for all the wrong reasons came to erode some of the good reputation the crypto community was able to build beforehand.

The advantages of a crypto bear market

Now let’s move on to the building stage. Why is the bear market suitable for building? Wouldn’t it be more sensible to sit back and wait for things to pick up steam? No, and here’s why.

Flashing the bad actors

Each crisis and each bear market has the unique ability to reveal those who were in it for personal and malicious reasons. The true benefit is not revealing these people and banning them from doing it again but rather the experience and knowledge we gain from it. The bear market is a great opportunity to learn what a threat looks like.

It allows us to not only identify threats but also build the necessary systems and take the appropriate precautions to shield our projects from them. The bear market takes the trash out and prepares those who stay for what’s to come. It gives builders a clean slate, the opportunity to build in an environment where bad actors have been removed.

When innovation becomes a survival necessity

When do great ideas come to fruition? When they are not optional but necessary for “survival”. To find ourselves in a bear market, something obviously went wrong. To recover from it, fresh ideas are not only welcomed, they are absolutely necessary. This is the best time to build, to test something new.

In times of prosperity, the market tends to follow trends and cycles and ideas sound, look and feel similar. It’s like the difference between “needing” and “wanting” something. The bear market needs new ideas. On the contrary, the bull market is powered by wants.

Back in November, Binance CEO Changpeng “CZ” Zhao, shared his opinion on the matter at the Web Summit in Lisbon. An amalgamation of lower labor costs and diminishing project value makes it easier for corporate acquisition and consolidation. “For example, a year ago, everybody wanted to sell a nonfungible token; but now, only the strongest of projects are doing it, so the selection is actually much better.”

Bigger talent pool

Coinbase recently announced that it was laying off 950 people, about 20% of its staff. This is part of a larger bear market trend that sees top talent being relieved of their duties. While that’s horrible, it is also an opportunity for new builders to find the talent that would otherwise be unavailable. Newer projects with limited budgets can access some of the brightest minds in the space.

Moreover, there is a lot of talent that was never given the opportunity to start their project, or work in a startup. A crypto winter and the bear market might be their way in.

Growing activity among Web3 developers

According to a survey of crypto developers conducted by the Web3 developer toolkit Hiro, 55% of developers say the bear market has increased their desire to work in Web3.

Another report by Web3 developer platform Alchemy, showed that smart contracts deployed on Ethereum increased by more than 50% despite the price of Ether falling about 60%. Moreover, the report showed rising weekly downloads (ether.js, web3.js) and 50% more smart contract deployment.

As opposed to earlier bear market scenarios, builders now have more Web3 educational resources and developer tools to enhance their building endeavours.

How Web3 startups can start preparing

Now let’s look at what you can do during the bear market.

Focus on value and usability

If we had to place a single, sweeping reason behind the bear market, that would be greed and people’s intention to use crypto and blockchain to make a quick buck. To reverse that, you should go back to the roots of blockchain technology and what it was meant to do in the first place. Stop treating it as an investment and a tool to achieve greater things. Building a project should be about delivering value to the end user. Creating a user-friendly experience. Gearing it up for mass adoption. Solving a real-life problem.

Reevaluate operations and cost structure

Bear markets highlight the need to manage an effective business that capitalizes on its advantages and addresses customer issues. When building in a bear market, it is an opportunity to lay the groundwork for a project’s future. Considering how hard it is to fundraise during a bear market, builders should be more interested in creating an effective, lean workflow.

Strengthen ties with your community

Building doesn’t always refer to product. In times of volatility and uncertainty, turning to your community and communicating is one of the most important steps. Going radio silent fuels negative feelings and leaves community members feeling in limbo.

Keep them involved, share content, discuss with them, ask their opinion, inform them on the roadmap and future plans, and invite other experts in the space for podcast episodes. There’s so much you can do to strengthen relationships and build trust. However, to maintain everyone’s confidence, engagement, and knowledge, be sure to try your best.

Seek for help and join forces with people in the know

What if there was a place, both physical and digital that could help you build, launch and scale your project in the Web3 space? Get you up to $100,000 in funding, support you with every step of the way, from tokenomics to marketing strategy and get you 1:1 meetings with potential stakeholders. What about selected mentorship from an active global partner network of +150 Web3 founders and companies?

All of this is possible through the Poolside Accelerator. The Web3 space is not abandoned, weak or crumbling. On the contrary, in challenging times, projects like the Poolside Accelerator came to life to help builders with fresh ideas, ambition and thirst, take their innovative projects to market.

About Poolside

Poolside Web3 accelerator is a 12-week remote combined with a 1-week in-residence (Lisbon) program designed to take the project from inception to execution to market. Selected projects will access initial funding and mentorship in marketing, token economics, legal, funding, business, blockchain, listing, and others.

Poolside Newsletter

Join the newsletter to receive the latest updates in your inbox.